Contenidos

> Top 5 rules to trading forex successfully

Technical analysis, news releases, stop losses and take profits set but I can’t seem to be profitable..why?

Lets have a look at what we believe are some of the most crucial elements to keep in mind when trading forex. Of course there are many more components such as technical analysis, risk/reward ratio etc. However, today we’re going to go over what we believe are some of the forgotten principles…

> 1. Always pair strong with weak

We’re always trading forex in currency pairs, every trade involves backing one currency against the other. to put this simply, think of the currency pair as a football match, Barcelona vs Real Madrid, both strong teams so usually the outcome is very close. However, put either up against a weaker team and it will be an easy victory. This is how the forex market works..

That means the highest possibility of making a profitable trade would be to pair a strengthening currency with a weakening one.

> 2. Being right and early means you’re wrong

Many traders’ suffer with the fear of missing out, entering trades early before sufficient directional confirmation signs are apparent. Whether it be a false breakout or any other type of false sign. always wait for the candle to close before committing to a trade, its ok to enter a little later and miss out on a few pips in return for a safer trade. Minimising losses goes a long way in becoming profitable.

> 3. Never risk more than you’re account can handle

Never underestimate the power of leverage! this is probably the most common bit of advice given in forex, nevertheless its the most ignored. Many amateur traders struggle with this concept, and subsequently end up emptying their trading account within days of starting, only to go on thinking forex trading is only suited to the big experienced investors.. well I can tell you thats not true.

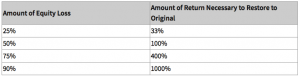

Remain relative to you’re account size, if you’re trading with $1000 you cannot open the same trade sizes as someone with a $10,000 account, this is common sense. losing a $100 in a losing trade could be acceptable to the latter while it would wipe 10% of the account of the former. Its always harder to recover from bigger losses..

Losing 50% on a $1000 account leaves you with $500 which then requires you to gain 100% just to return to you’re original amount. Manage you’re losses so you can stay in the game.

> 4. Logic wins, impulse kills!

One of the main misconceptions that lose beginner traders money is the idea that “it has gone down, therefore it must go up” this is not always the case, in fact, if its going down, its likely to keep going down. this is impulsive thinking.

Focus on you’re technical analysis and wait for all sufficient indicators before placing a trade.. don’t gamble, instead make logical decisions.

This also applies to open trades, more often than not there will be movement against you’re direction. don’t panic and act impulsively, if you’ve done you’re preparations and set you’re stop losses, there’s no need to panic. Let you’re profits run.

> 5. Set realistic goals

Controlling you’re greed is crucial if you want to become a successful trader. Many traders come in to trading with the assumption of it being a get rich quick scheme.. it isn’t.

The story of forex being sold is once you begin trading you can move away to a tropical island with only a laptop and live on a beach sipping a strawberry daiquiri..also false.

Trading is a long game, profits are only relative to your investment as it is with most investments. Once you accept this, you will be able to control you’re greed and begin growing your trading account accordingly without allowing you’re emotions to take over you’re logic.